WIOA Billable Time Guidelines

Comprehensive Compliance Framework for Workforce Development Grants

Navigate complex WIOA and Department of Labor regulations with confidence. Learn what staff time can be charged to grants, required documentation, and how to maximize the value of your workforce development funding.

Understanding WIOA Billable Time

The U.S. Department of Labor does not publish a simple billable hours chart. Instead, Uniform Guidance and WIOA cost principles define how time must be classified, documented, and allocated.

Direct Program Time

Fully billable activities that directly support participant outcomes.

Administrative Time

Billable time that must remain within the 10% administrative cap.

Non-Billable Time

Activities that cannot be charged to WIOA or Department of Labor grants.

Governing Rules and Regulations

Key regulatory frameworks that define WIOA billable time requirements for state and local workforce boards, intermediaries, and service providers.

Primary Regulations

- 2 CFR Part 200 (Uniform Guidance)

Defines allowable costs, cost allocation, and documentation requirements for federal grants.

- 20 CFR 683.215

Distinguishes administrative costs versus program costs for WIOA Title I funds.

- 20 CFR 618.860

Trade Adjustment Assistance fiscal requirements and cost classifications for co-enrollment.

Guidance Documents

- TEGL 2-07

Clarifies WIOA cost classification guidance and examples.

- TEGL 14-18

Aligns performance accountability with allowable program and administrative costs.

- 2 CFR Part 2900

Department of Labor specific grant requirements layered onto Uniform Guidance.

Billable Time Categories

Understand how WIOA and related workforce development grants classify staff time and associated activities.

A. Direct Program Time (Fully Billable)

These activities directly support participant outcomes and may be charged to program cost categories.

- Case management & eligibility determination

- Developing Individual Employment Plans

- Career services & job placement

- Training coordination (OJT, apprenticeship)

- Supportive service coordination

- Employer engagement for placements

- Tracking skill gains & credentials

B. Administrative Time (Capped at 10%)

Under 20 CFR 683.215(b), these activities must be tracked within the 10% administrative cost cap across all Title I funding streams.

- Accounting, budgeting, payroll

- Procurement & property management

- Audit resolution & monitoring

- General legal services

- Policy development

- Centralized IT & HR support

C. Non-Billable / Unallowable

These activities cannot be charged to WIOA or Department of Labor grants regardless of funding pressure or program needs.

- Lobbying & political activity

- Fundraising activities

- Entertainment & alcohol

- Fines & penalties

- Supplanting state/local funds

- Cross-funding without allocation

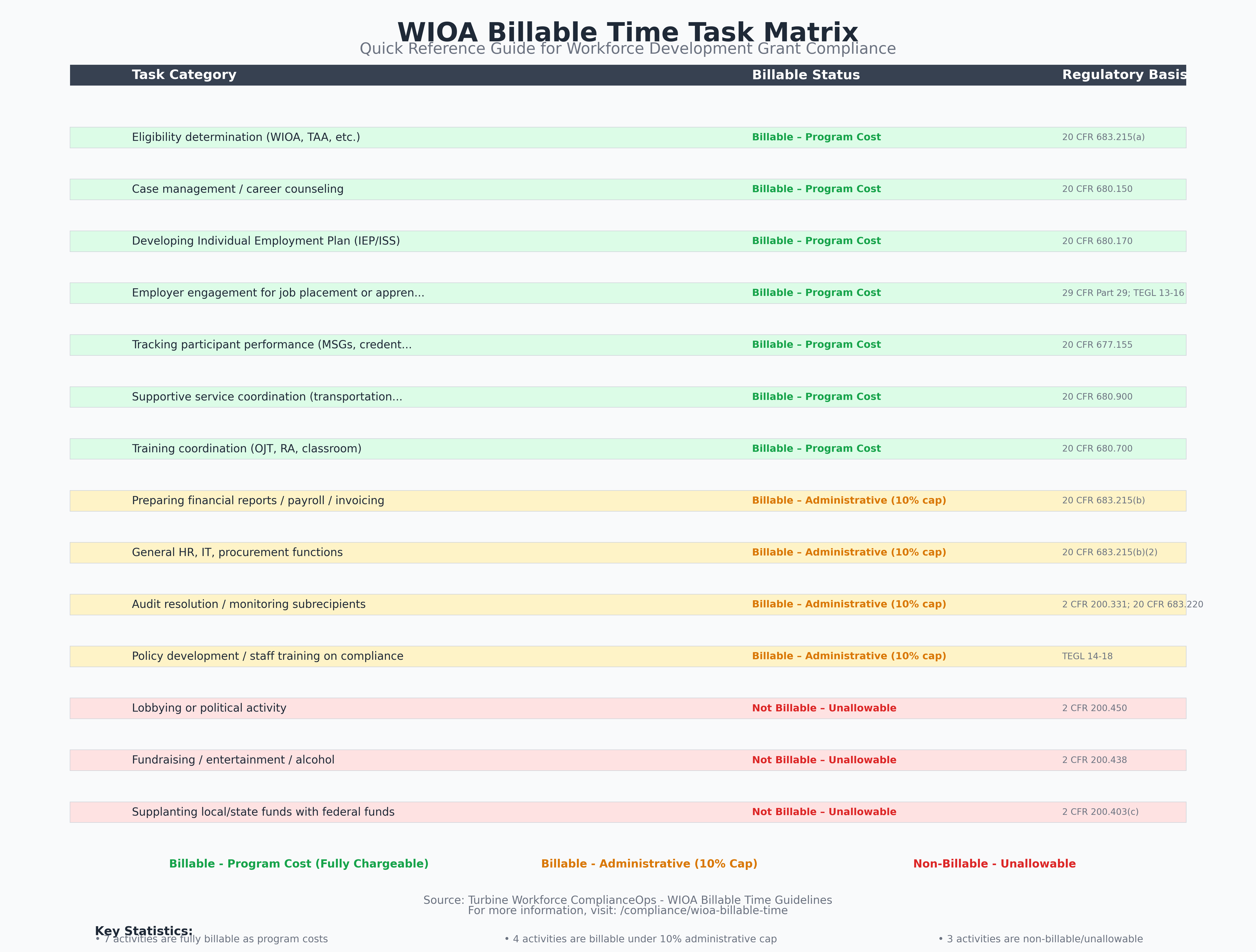

WIOA Billable Time Task Matrix

Quick reference for the most common workforce development activities and how auditors classify them.

| Task Category | Billable Status | Regulatory Basis |

|---|---|---|

| Eligibility determination (WIOA, TAA, etc.) | Billable – Program Cost | 20 CFR 683.215(a) |

| Case management / career counseling | Billable – Program Cost | 20 CFR 680.150 |

| Developing Individual Employment Plan (IEP/ISS) | Billable – Program Cost | 20 CFR 680.170 |

| Employer engagement for job placement or apprenticeship | Billable – Program Cost | 29 CFR Part 29; TEGL 13-16 |

| Tracking participant performance (MSGs, credentials) | Billable – Program Cost | 20 CFR 677.155 |

| Supportive service coordination (transportation, childcare) | Billable – Program Cost | 20 CFR 680.900 |

| Training coordination (OJT, RA, classroom) | Billable – Program Cost | 20 CFR 680.700 |

| Preparing financial reports / payroll / invoicing | Billable – Administrative (10% cap) | 20 CFR 683.215(b) |

| General HR, IT, procurement functions | Billable – Administrative (10% cap) | 20 CFR 683.215(b)(2) |

| Audit resolution / monitoring subrecipients | Billable – Administrative (10% cap) | 2 CFR 200.331; 20 CFR 683.220 |

| Policy development / staff training on compliance | Billable – Administrative (10% cap) | TEGL 14-18 |

| Lobbying or political activity | Not Billable – Unallowable | 2 CFR 200.450 |

| Fundraising / entertainment / alcohol | Not Billable – Unallowable | 2 CFR 200.438 |

| Supplanting local/state funds with federal funds | Not Billable – Unallowable | 2 CFR 200.403(c) |

Documentation Requirements

Essential records your organization must maintain to charge staff time to WIOA or Department of Labor funding streams.

Time & Effort Certifications

Signed by employees or supervisors, documenting actual time spent on allowable grant activities.

Cost Allocation Plans

Required when time is split across WIOA, TANF, SNAP E&T, or other funding sources to ensure proper distribution.

Activity Linkage Records

Evidence that hours are tied to allowable activities and participant outcomes such as MSGs or credentials.

Turbine Workforce ComplianceOps Integration

How Turbine Workforce helps workforce agencies maintain continuous compliance while scaling services.

Automated Compliance Management

Automated Time Tracking

Real-time categorization of billable versus non-billable activities.

10% Administrative Cap Monitoring

Dashboards that watch admin spending against Title I limits.

Documentation Templates

Pre-built time-and-effort and cost-allocation templates aligned with DOL guidance.

Cost Allocation Tracking

Track hours across multiple grants with compliant backup documentation.

Key Benefits

Ready to Strengthen WIOA Compliance?

See how Turbine Workforce simplifies time tracking, documentation, and reporting so your team can focus on participant outcomes.